News

State Farm Sales Leader Christie Poulin with Rep. Don McLaughlin

Rep. Salman Bhojani and State Farm Sales Leader Brian Shelton

Rep. Carrie Isaac, State Farm Agent Karen Easterling, and former Rep. Jason Isaac

State Farm Agent Bert Simmons with his daughter Rep. Laura Ashley Simmons

State Farm Agent Brandy Whiteside and Rep. Vikki Goodwin

Rep. Vince Perez and State Farm Agent Daniel Call

State Farm Sales Leader Christie Poulin and Rep. Cole Hefner

State Farm Vice President Jeremy Bolen and Rep. Valorie Swanson

Rep. Charles Cunningham and State Farm Agent Trey Guidry

Rep. Ramon Romero, State Farm Agent Karen Easterling, and Rep. Mike Schofield

Rep. Matt Shaheen, State Farm Agents Vic McLane, Stephanie South and John Jinuntuya

State Farm Agent Ken Quach, Rep. Valorie Swanson, Agent Trey Guidry, Rep. Mike Schofield, and Counsel to the Governor Steve Munisteri

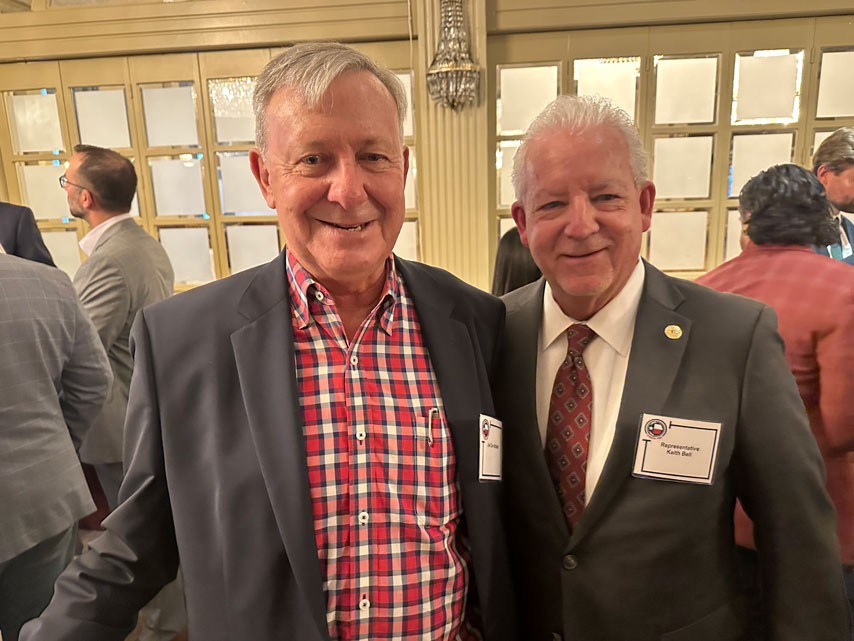

State Farm Agent Joe Dan McNeth and Rep. Keith Bell

State Farm Sales Leader Ryan Meier, Rep. Jeff Barry, and Agent Steve Sipes